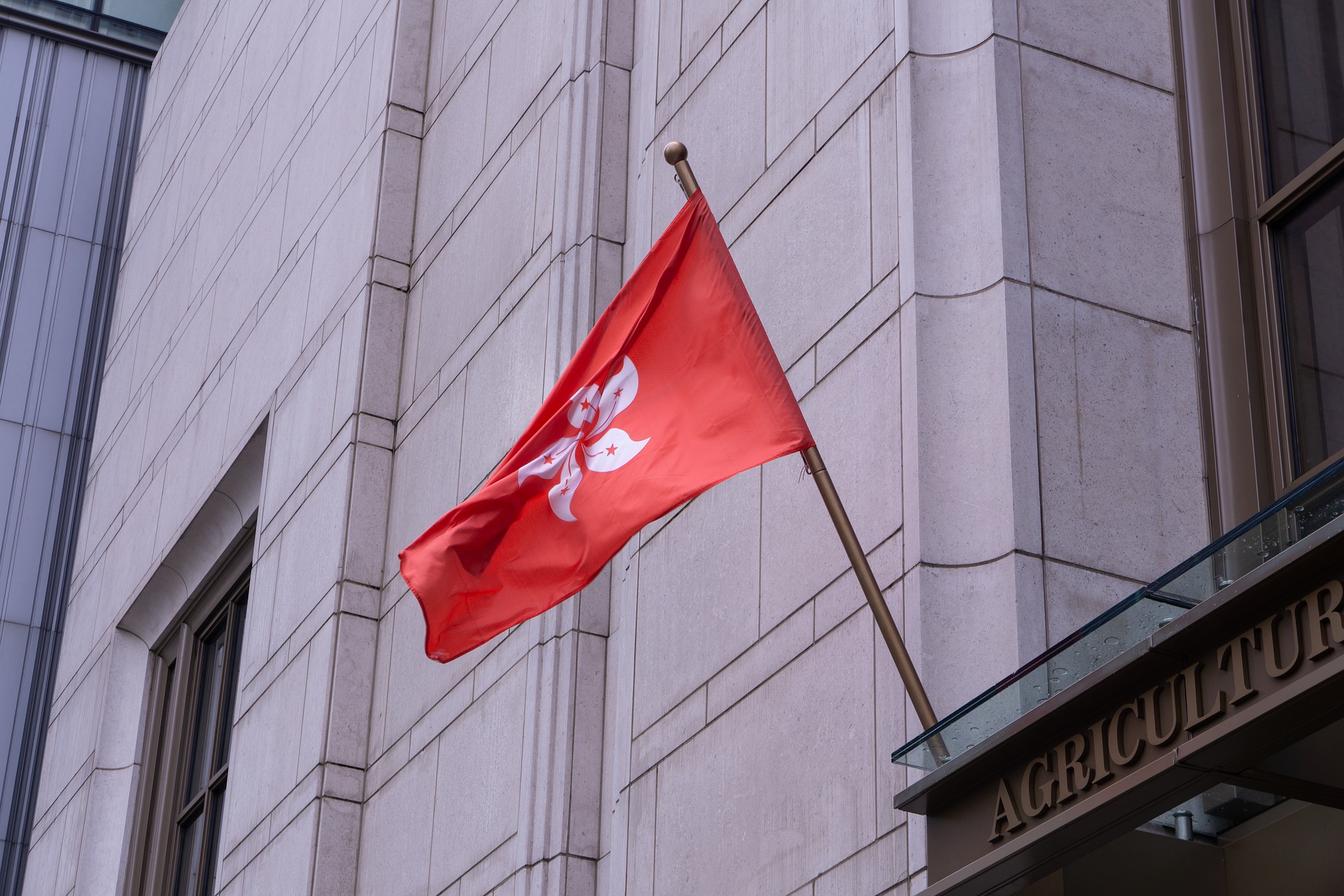

Hong Kong wants Coinbase and other digital asset companies to come and do business there, while the US is making it harder for them to operate. Johnny Ng, who is part of Hong Kong’s Legislative Council, said he can help with the move.

Ng invited virtual asset trading operators, such as Coinbase, to come to Hong Kong for official trading platforms and development plans through a tweet. Feel free to contact me if you need help.

The invitation was sent after the SEC sued big crypto exchanges like Binance and Coinbase. Coinbase is accused of breaking securities laws and not registering as a broker-dealer, and Binance is accused of breaking different rules.

US regulators are being strict about crypto, but Hong Kong is trying to be more friendly towards it. Hong Kong now requires trading platforms and exchanges to obtain a licence through the Securities and Futures Commission (SFC), as reported by Nikkei. “We aim to enable people to trade digital assets in retail later this year.”

Hong Kong only allows institutional investors and professionals to trade cryptocurrency since 2018. Julia Leung, who is the CEO of Hong Kong’s Securities and Futures Commission, says that Hong Kong has a good set of rules for virtual assets. She says that our framework makes sure that virtual asset businesses have the same risks and rules as traditional businesses. This helps protect investors and manage risks. This will help industries grow and innovate sustainably.

Over 80 companies want to get a licence in Hong Kong because they think it’s a good place for digital asset companies.

Read Also: Analyst Identifies Two Major Altcoins Set to Impact Markets During Ongoing Market Decline

Comments are closed.