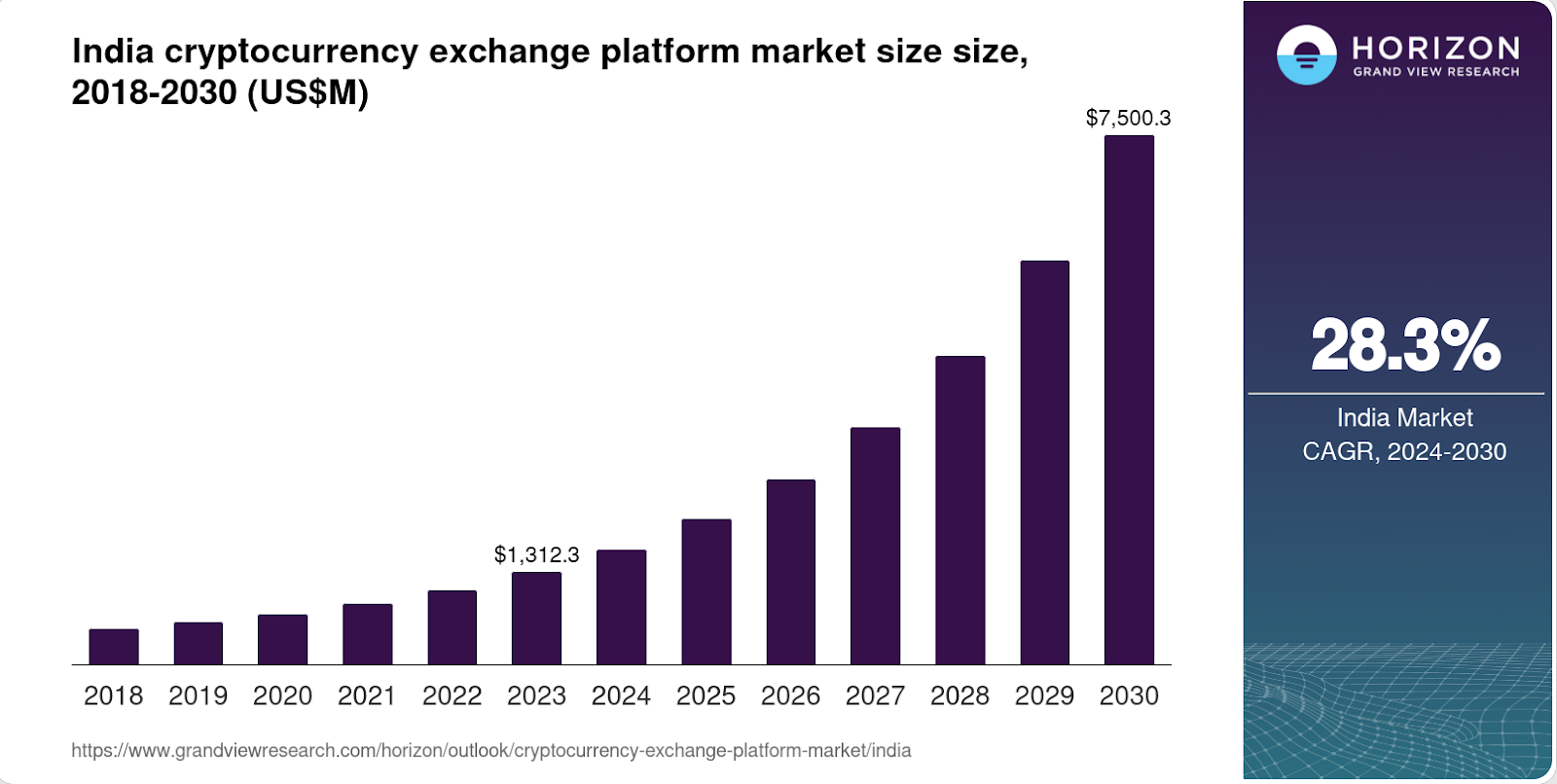

India is the second-largest crypto market globally, and its growth shows no signs of slowing down. In fact, the Indian crypto exchange platform market is projected to expand at a compound annual growth rate (CAGR) of 28.3% between 2024 and 2030.

However, crypto F&O trading in India has long been complicated by the reliance on USD or USDT settlements. This has led to issues like currency conversion costs, tax problems, and transfer delays. INR-settled crypto futures and options address these challenges. They allow traders to deposit, trade, and withdraw funds directly in Indian Rupees. This eliminates the need for foreign currency transactions.

Platforms like Delta Exchange India make crypto F&O trading simpler, more cost-effective, and tax-efficient for Indian traders.

In this post, we’ll explain how INR-settled crypto futures and options work, their benefits, and why Delta Exchange India is the best platform for trading futures in India.

What Are Crypto Futures and Options?

Crypto futures and options allow traders to speculate on price movements without holding the underlying asset. While futures contracts lock in a buy or sell price for a set date, options give traders the right, but not the obligation, to execute a trade at a predetermined price.

How Do Crypto Futures & Options Work?

- Crypto Futures Trading: Traders go long if they expect prices to rise or short if they anticipate a drop. These leveraged trades require only a fraction of the contract value. At expiry, settlements occur in INR, eliminating the need for USDT or USD conversions.

- Crypto Options Trading: Traders buy call options to profit from price increases or put options to benefit from declines. Since options don’t require mandatory execution, traders can limit downside risk while leveraging upside potential.

For instance, a trader buys a BTC futures contract at INR 35 lakh and sells at INR 36 lakh, making INR 1 lakh (excluding fees). In options trading, if BTC rises, a call option buyer profits, while a put option buyer benefits from a price drop.

This dual crypto trading strategy allows traders to manage risk and maximize opportunities in the crypto market.

Why INR Settlement Matters for Indian Traders

Most crypto futures and options platforms settle trades in USD or USDT, creating inefficiencies for Indian traders. INR settlement eliminates these issues:

| Issue with USD/USDT Settlement | Benefit of INR Settlement |

| INR to USDT conversion incurs 1-2% fees. | Trade directly in INR with zero conversion fees. |

| Direct crypto trades attract 1% TDS & 30% tax. | INR-settled trades avoid 1% TDS. |

| Restrictions on international fund movement. | No forex-related issues. |

| USDT-INR fluctuations impact profits. | No dependency on USD or USDT. |

INR settlement offers a cost-effective, tax-efficient, and seamless trading experience for Indian traders.

Delta Exchange India: The Best Crypto F&O Trading Platform in India

Delta Exchange India offers traders a secure and feature-rich environment to trade crypto futures and options. Key highlights include:

- Wide Range of Contracts: Daily, weekly, and monthly expiries available.

- Flexible Lot Sizes: Start trading with BTC contracts as low as INR 1,000 and ETH contracts for INR 800.

- INR Deposits & Withdrawals: No need for USDT or USD.

- Advanced Trading Tools: Strategy builder, basket orders, options analytics, and risk management features.

- High-Speed Matching: Execute trades at market prices without slippage.

- Leverage Up to 100x: Trade with high capital efficiency.

- FIU Registered: A regulated exchange ensuring compliance and security.

- 24/7 Support: Dedicated assistance whenever you need it.

How to Start Crypto F&O Trading in India with INR Settlement

Follow these simple seven steps and start crypto F&O trading in India:

- Sign up on Delta Exchange India.

- Deposit INR via UPI, bank transfer, or IMPS.

- Select BTC, ETH, or other available crypto futures and options.

- Set your trade direction (long for rising prices, short for falling prices).

- Adjust risk exposure based on market conditions.

- Place your order using market, limit, stop, or bracket orders.

- Monitor and close your position, then withdraw INR directly to your bank.

Bottomline

Delta Exchange has created a cryptocurrency derivatives trading platform designed specifically for the Indian market, ensuring it avoids crypto tax issues and complies with local regulations.

Stay updated on market trends and price changes by visiting their website. You can also follow Delta on X and Instagram.

Disclaimer: Cryptocurrencies are highly volatile, and investing in them involves significant risk. The content of this article is not intended as financial advice. We strongly recommend conducting your own research before making any investments.

FAQs

1. What is INR-settled crypto F&O trading?

It allows Indian traders to trade both crypto futures and options, with profits and losses settled in INR. This eliminates the need for USDT or USD conversions, reducing conversion fees and tax liabilities, making the trading process more cost-effective and tax-efficient.

2. How is INR settlement different from USDT settlement?

INR settlement eliminates forex fees, tax complexities, and transfer restrictions associated with USDT-based trading.

3. Does INR-settled trading attract 1% TDS and 30% crypto tax?

No, since these trades are derivatives and not direct crypto transactions, they are not subject to the 1% TDS rule.

4. How can I start trading INR-settled crypto futures and options?

Register on Delta Exchange India, deposit INR, choose a crypto futures and options contract, and start trading with leverage.

Read Also: Tether, Guinea Team Up to Explore Blockchain

Comments are closed.