The Securities and Exchange Commission denied Grayscale’s request for its Bitcoin fund to be converted into an exchange-traded fund for a second time.

The Securities and Exchange Commission has confirmed its decision to reject Grayscale’s exchange-traded fund proposal for Bitcoin (ETF).

The federal regulator reaffirmed its view that such products are susceptible to fraud and manipulation. Back in June of this year, it turned down Grayscale’s offer to transform its Bitcoin Trust into an exchange-traded fund.

Grayscale stated that the SEC was unfairly targeting ETFs that invest in Bitcoin spots. In response to the denial, Grayscale filed a lawsuit against the SEC. It said that the regulator was adopting a double standard by permitting only Bitcoin futures ETFs to trade on the market.

Grayscale additionally claimed that the SEC discriminated unreasonably and arbitrarily between issuers of the two categories of ETFs. Grayscale stated that by establishing this “unequal playing ground,” the SEC was unfairly disadvantageous to its stockholders.

In its response brief, the SEC reaffirmed its rationale for licensing Bitcoin futures ETFs. Bitcoin spot ETFs lack government control, but Bitcoin futures ETFs are extensively supervised by the Chicago Mercantile Exchange. Due to the inherent risks presented by each form of cryptocurrency product to investors, the SEC has said that it will differentiate between the various types of cryptocurrency products.

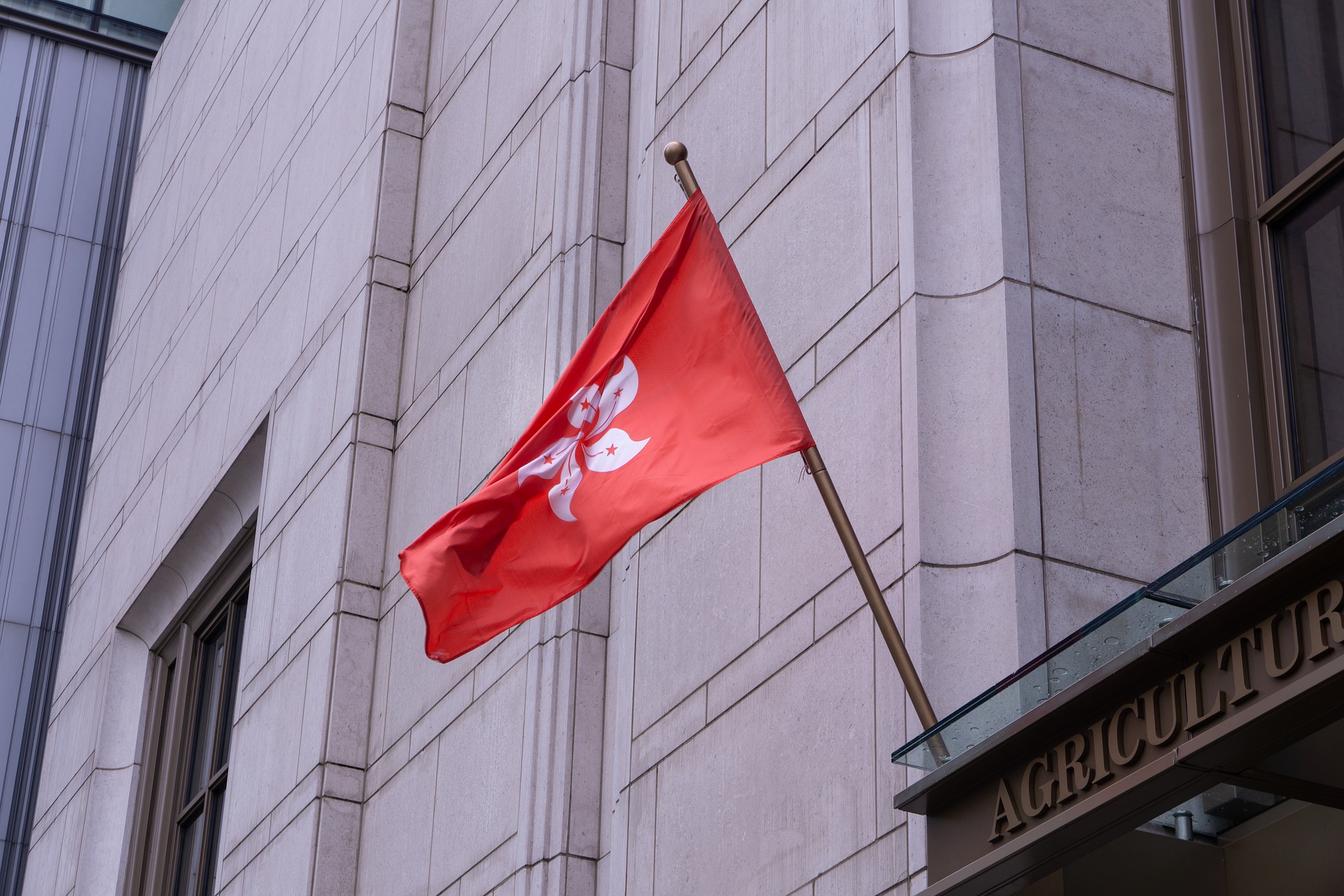

Because of the scope of these consumer protections, Hong Kong authorities have also authorized them. Earlier today, Hong Kong’s first crypto-based ETFs launched and ended their maiden trading day with gains. Local CSOP Asset Management administers both products, which invest in CME-listed bitcoin and ether futures.

Comments are closed.