Tallinn, Estone, 14th October, 2021, Chainwire

Leading digital asset wealth management platform grows assets to $339 million and sponsors West Ham United just eight months from public launch

YIELD App, a FinTech company and digital asset wealth management platform, has published its Q3 report, showing the firm continuing on a strong growth trajectory over the third quarter of 2021, which saw it double its managed assets and strike a high profile partnership with Premier League football club, West Ham United.

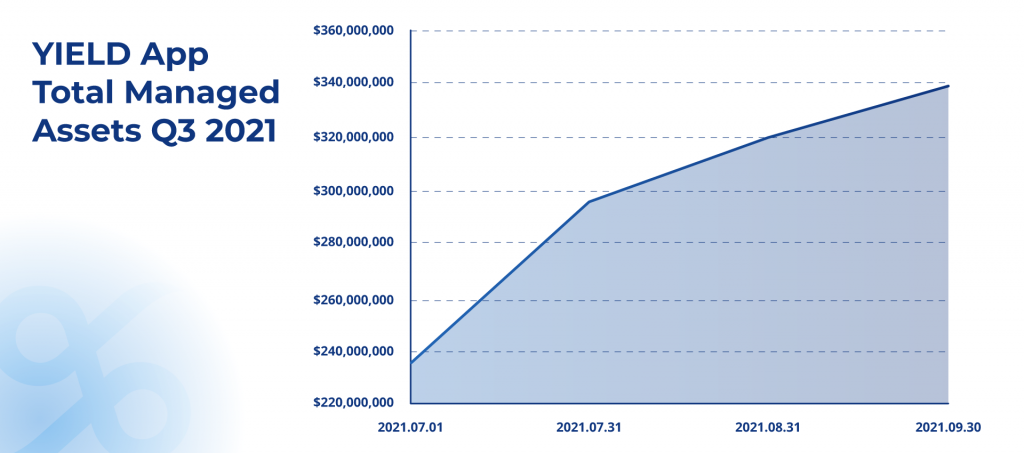

The quarter saw YIELD App’s managed assets increase by 107% from $163.6 million at the end of June 2021 to $339.4 million by the end of September, marking a bold first nine months for YIELD App following its beta launch in December 2020 and public launch in February of this year.

YIELD App said the increase had been driven in large part by the launch of its Bitcoin Fund in July, which reached its cap of 500 BTC in just a few days of its first fundraising round. The re-opening of the fund in August also saw one of the firm’s biggest days for new user sign-ups, with close to 1,500 new users joining on August 20th.

Asset growth was further boosted by a growing number of corporate and institutional clients, with YIELD App reporting that it now serves well over 60 clients in this segment, ranging from blockchain companies to traditional investment vehicles to family offices across Europe, Asia, and Australia.

The report states that the highlight of the three months to the end of September, however, was YIELD App’s partnership with West Ham United, a Premier League football club based in London in the UK. YIELD App is now the official Digital Asset Wealth Management partner of the club until the end of the 2021/22 season in June 2022.

YIELD App says the deal will see the digital wealth management platform feature throughout West Ham United’s communications with its 60 million fans across the world, significantly broadening the reach of digital assets to mainstream audiences.

The Q3 report also sees YIELD App enhance its transparency by significantly expanding its portfolio reporting to include extensive information on risk management, insurance pools, and how the firm invests users’ funds. The firm says it has contracted top blockchain auditing and accounting firm Armanino to report on its reserves, while it is also partnering with up-and-coming DeFi risk-modeling platform Credmark for further auditing.

Commenting on the YIELD App Q3 Report, Tim Frost, CEO of YIELD App, said: “In the nine months since our beta launch in December 2020, YIELD App has gone from strength to strength, growing at an unprecedented pace. In the latest quarter alone, we have seen our managed assets more than double and secured an exciting new partnership with West Ham United that places us among the top tier of digital asset wealth platforms.

“I couldn’t be more pleased with how the first nine months of our business have gone and I am thoroughly looking forward to the successes that await us in the last three months of the year, and beyond. With our strong and growing team and our market-beating proposition, I am confident YIELD App will become a leading platform for anyone interested in digital assets, anywhere in the world.”

Please click here to view the full YIELD App Q3 Report

About YIELD App

YIELD App believes that everyone should have access to the best investment opportunities. Its mission is to unlock the full potential of digital assets, combine them with the most rewarding opportunities available across all financial markets and make these available to the world. To achieve this, the company provides an innovative digital asset wealth management platform that bridges traditional and decentralized finance in the easiest way possible. For more information, visit www.yield.app

Contacts

Head of Communications

- Rebecca Jones

- YIELD App

- rebecca@yield.app

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. Cryptocurrency investments are subject to market risks, and individuals should seek professional advice before making any investment decisions.

Comments are closed.